Home » Tax Administration

Category Archives: Tax Administration

Remote Work in Tax Administrations Survey

By Ioannis Lentas, Nikolaos Moustakidis and Bettina Derpanopoulou

Human Resources Directorate

Independent Authority for Public Revenue, Hellenic Republic

Introduction

The COVID-19 pandemic has had a devastating impact on health and the economy across the globe. Governments have taken measures to control the spread of the virus and the consequences arising from this. These measures, include, for example, restriction of movement, social distancing, closed schools, and mandatory working from home. Though the production chain has been severely affected, governments have responded quickly by putting plans in place for ‘Remote Working’ (or ‘teleworking’). This blog discusses the results of a survey conducted by the Independent Authority for Public Revenue (IARP) of Greece via the Intra-European Organisation of Tax Administrations (IOTA) network. The objective of the survey was to better understand the challenges around ‘Remote Working’ in tax administrations and, importantly, identify the extent to which this mode of working can be sustained in the future. The survey was carried out during the summer of 2020 (through June-August) and it involved HR department managers from twenty two Tax Administrations [1]. The survey consisted of 13 closed questions.

With the risk of oversimplification the survey shows that respondents thought that:

- tax administrations have reacted quickly to introduce remote working,

- remote working, if managed well, can help in enhancing productivity but the impact on well-being needs to be understood and considered, and

- remote working cannot be applied horizontally across the organisations.

Figure 1: map of participating (in blue) countries

Main Findings

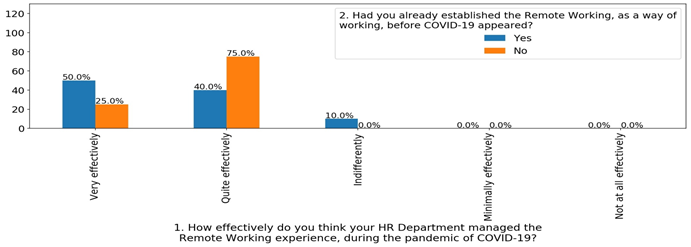

The majority of respondents (>95%) stated that their HR Department was effective in managing the remote working scheme during the COVID-19 pandemic, in spite of the fact that the majority (54.5%) had not previously established the practice before the start of the pandemic, in spite of the fact that the majority (54.5%) had not previously established the practice before the start of the pandemic.

Figure 2: Managing remote working

In addition, one third of the participants said that the organisation do not possess the technological equipment to effectively work away from their offices.

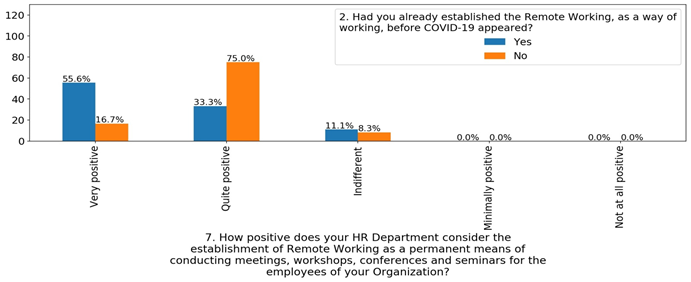

Interestingly, respondents (>90%) view the potential of remote working to conduct online meet-ups and seminars add real value to the organization.

The survey identified that respondents held different views on the frequency of ‘Remote Working’ and the needs associated with this, with most respondents preferring remote working for a specific number of days each week.

Remote working, however, is widely thought (80%) of being impossible to apply in a horizontal manner across all employee jobs and some differentiation would have to be made according to the tasks undertaken by the employees.

More specifically, the best fit for a remote working scheme was (in descending order): headquarter (70.6% selection rate), managerial, audit and lastly taxpayer service jobs (a mere 11.8% selection rate).

With regard to measures taken to help staff face the COVID-19 pandemic, tax authorities have responded quickly and provided information on contraction and spreading prevention measures. To a much limited extent, some organisations provided special care to vulnerable groups (45%) and 40% provided antiseptics.

A slim majority of respondents were also found to have conducted a survey to inquire staff members about their well-being (54.5%).

It was also reported by the vast majority of respondents (>90%) that their department (HR) was actively involved in the decision making process during the COVID-19 crisis.

Overall, a strong majority of over 85% of respondents appeared to be satisfied with the manner in which the crisis was handled by their organizations.

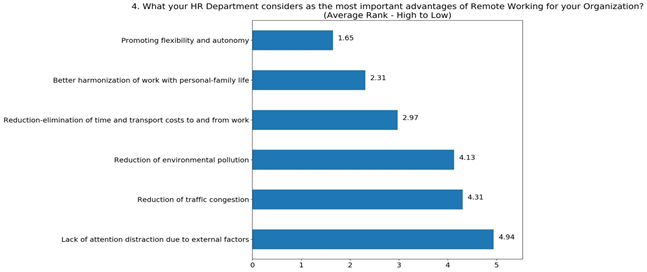

The top three recognised benefits of remote working comprise the flexibility and autonomy it offers, the improvement in professional-personal life balance and the elimination of transportation time and cost.

Figure 3: Advantages of remote working

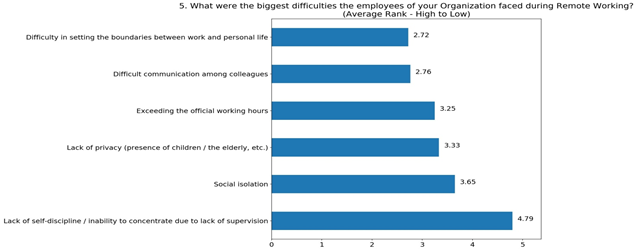

On the flip side, the three most important difficulties in applying remote working were identified to be issues of setting boundaries between work and personal time, difficulty in communication among colleagues, and exceeding the official work hours.

Figure 4: Difficulties of remote working

Effect of established Remote Working implementation

We now explore how respondents with and without previously established implementation of remote working schemes answered the questionnaire in order to identify how this prior experience affects their responses.

Previous experience in remote working appears to correlate with more positive assessments of the COVID-19 response to implement remote working.

Figure 5: Overall effectiveness assessment vs. established remote working implementation

Established remote working schemes also correlate to a more positive view of remote working as a permanent means of conducting meeting activities.

Figure 6: Remote working as a permanent means of meeting vs. established remote working implementation

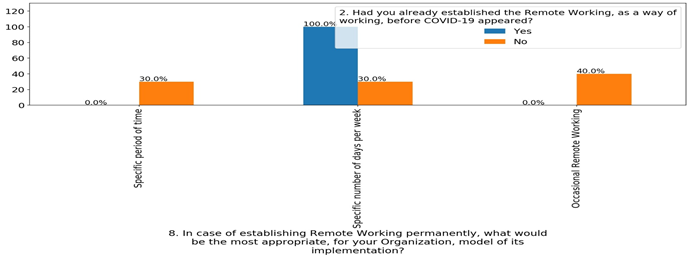

All respondents with established remote working agreed that a specific number of days per week is the more appropriate setup while those without were evenly split among the three options.

Figure 7: Remote working scheme selection vs. established remote working implementation

Those experienced with established remote working programs consider to a much higher degree (37.5% vs 8.3%) that remote working can be applicable to all jobs.

Another difference is the level of involvement that HR departments had in operational decisions during the COVID-19 pandemic. Organizations with established remote working were far more involved in the process (almost 90% reported ‘Fully’ participating) than those without (41.7% respectively).

Respondent Similarity – Clustering

Using the replies provided by the participating countries in the survey we can see how similar they are in their views and implementation on remote working and their response to the COVID-19 crisis.

Based on a similarity and clustering analysis three distinct clusters emerge:

Cluster No.1 comprising Belgium, Germany, Estonia, United Kingdom, Hungary, Poland, Portugal, Slovakia and Finland features excellent overall response satisfaction, previous experience with remote working, high HR involvement in decision making, significant means to apply remote working, and highly positive attitude towards remote working for use in meetings.

Cluster No.2 comprising Bulgaria, Latvia, Belarus, Moldova and Romania features the second best rates (after cluster No.1) in overall response satisfaction and in positive attitude towards remote working for use in meetings.

Cluster No.3 comprising Armenia, Greece, Spain, Malta, Norway, Russia and the Czech Republic features the second best rates (after cluster No.1) in previous experience in remote working, level of HR involvement in decision making and in means to apply remote working.

Conclusion

The survey showed that remote working, even in the occasions that was introduced for the first time, functioned quite effectively. It also showed that there are productivity gains from remote working but under the condition that it is designed correctly.

Therefore, it is of high importance to understand its challenges and take them seriously into consideration so that it can become more sustainable for the future, more efficient in terms of productivity and more appropriate for the well being of the employees.

[1] The countries which participated into the survey are: Armenia, Belarus, Belgium, Bulgaria, Czech Republic, Estonia, Finland, Germany, Greece, Hungary, Italy, Latvia, Malta, Moldavia, Norway, Poland, Portugal, Romania, Russia, Slovakia, Spain, United Kingdom.

The Anthropology of Tax

By Lotta Björklund Larsen & Robin Smith

Taxation is a truly multi-disciplinary subject and there are many social and cultural explanations offered for how people and corporations relate to taxation. Economics, legal studies, critical tax studies, and even sociology have made many significant contributions in this broad theme approaching it with a multidisciplinary lens. Thus, it is apt to ask, what may anthropology – the scientific study of humans, human behavior, and societies – add to tax scholarship? We dare to say, many things.

As researchers of human relations, human behavior, and societies, anthropologists are especially interested in the relation between various aspects of human existence. The aim is double-sided. On the one hand, anthropologists shed light on the social and cultural variations in society, while on the other hand they aim to describe and understand the similarities between societal institutions and human relations throughout the world. This has several implications. For example, anthropologists bring an actor-centered perspective to the scholarship of taxes, focusing on what people actually do and how they give meaning to their actions. Regarding taxation, what does it mean to pay tax in different places and for different people? What understandings of exchange, responsibility, and reciprocity are brought to bear on tax arrangements? How do fiscal cultures shape economic and moral subjects, and indeed what constitutes a fiscal culture? These are interesting issues in their own right, but especially so when placed in relation to tax laws and how such laws are interpreted in practice when collecting revenue. Anthropologists are less concerned about following the money than following the relationships formed by fiscal responsibilities, but they recognize that taxation is more than a tool for a state to bring in revenue – it is a mode of social organization, a way to structure the economy, a way to shape social welfare systems, and reflects economic and social values in a given society.

Methodologically, anthropologists articulate ethnographic accounts of what people actually do, in private life and as professionals, observing them close-up in their everyday practices. This means that we develop close relationships with our informants so that we may formulate first-hand accounts of their lives in order to gain insights. This is particularly important for opening honest discussions about their financial lives. Taxation may be at once viewed as a moral duty and unjust depending on the type or amount of tax, mode of enforcement, and myriad other local factors. Anthropologists endeavor to tease out the tensions, contradictions, and values undergirding peoples’ perceptions of tax regimes that extend beyond revealing modes of tax evasion or avoidance. Indeed, understanding how to increase compliance can sometimes be an afterthought in many of our studies. Rather than focused on a specific outcome, anthropologists seek to understand the social and cultural mechanisms at work that inform local tax behaviors and local economic values and beliefs.

‘Being there’ when taxation is done is not always easy, whether the focus of analysis is taxpayers, tax collectors, or tax advisors, but anthropologists, with our long-term field methods, seek to embed ourselves in such groups by gaining trust and simply playing the long game by living in a community. Taxation can be considered a private practice, particularly if citizens are not always compliant. Indeed, in some cases one might think the designation ‘taxpayer’ is a misnomer if those citizens are cast as tax avoiders, evaders, and even cheaters – but ethnographic accounts of taxation reveal that such designations are not nearly fine-grained enough. One may, for example, happily pay one type of tax whilst refusing to pay another, as Miranda Sheild Johansson (2020) showed in her study of Bolivians working in the informal economy. Casting light on why this is the case can teach us a lot, especially in times when society and cultural values are quickly changing. The explanation for why a given community or group of people does or does not comply with a particular taxation regime may be legal, economic, political, social, or cultural – or a combination of these. Aiming to take the various aspects of being a taxpayer into account reflects our approach of taking nothing as a given.

There are many ethnographic studies of taxation that led to this recent upswing in our focus on taxation. In Africa, we have seen taxes central role in democratization in Nigeria (Guyer 1992) and that ‘fiscal disobedience’ among Cameroonians actually was a way of redefining citizenship (Roitman 2005). Studies of tax administrations in contemporary Northern Europe have, for example, addressed tax inspectors’ selective gaze in Denmark (Boll 2014) and how tax analysts shape taxpayer compliance in contemporary Sweden (Björklund Larsen 2017).

Anthropologists are currently engaged in a wide variety of tax-related research projects that build on ethnographic methods and qualitative data collection. Researchers are working on such themes as the digitalization of tax, tax havens on island nations, migration, tax lotteries, and so much more. We gather insights about concepts such as governance with a geographical focus, such as in the special issue Governing through Taxation analyzing the role of taxation and its social affects a selection of African countries (2018). In another special issue, Beyond the Social Contract: An Anthropology of Tax (Social Analysis, 2020), authors question the almost taken for granted concept of tax as social contract between state and society. Instead, contributors brought forth concepts such as ‘fiscal commons’, ‘rightful returns’, and ‘timebanking’ as modes of community economic self-organization outside of the state’s fiscal purview. There is a special issue in the works with a leading academic journal on reciprocity and redistribution that brings in new scholarship to the anthropology of tax. An edited book volume with a leading British academic press with fifteen contributors is also in progress. Many of the works in progress from contributors are on topics that broaden the anthropology of tax in new and interesting ways. Projects such as these will be announced on our newly launched network website, where you can find announcements for anything from conference CfPs to new books, profiles of anthropologists interested in sharing their current research, a resources page that has an ongoing bibliography of anthropological publications related to taxation as well as links to other research resources, and a blog where we hope people will share more extensive updates on their tax related work. Find us here: https://tax-anthro.net.

Various constellations of anthropologists in our network are embarking upon a whole host of collaborations that will add depth and breadth to the anthropology of tax. More, much more, is coming, and we look forward to engaging with tax scholars across disciplines.

Lotta Björklund Larsen & Robin Smith

Björklund Larsen, L. (2017). Shaping taxpayers: values in action at the Swedish tax agency. New York, Oxford: Berghahn Books.

Boll, K. (2014). Shady car dealings and taxing work practices: An ethnography of a tax audit process. Accounting, Organizations and Society, 39(1), 1–19.

Guyer, J. I. (1992). Representation without Taxation: An Essay on Democracy in Rural Nigeria, 1952-1990. African Studies Review, 35(1), 41–79.

Makovicky, N. & R. Smith (eds.). 2020. Special Issue: Beyond the Social Contract: An Anthropology of Tax. Social Analysis 64(2). https://www.berghahnjournals.com/view/journals/social-analysis/64/2/social-analysis.64.issue-2.xml

Owen, Oliver (ed.). 2018. Special Issue: Governing through Taxation. (Gouverner par la fiscalité) Politique Africaine 151(3). https://www.cairn-int.info/journal-politique-africaine-2018-3.htm

Roitman, J. L. (2005). Fiscal Disobedience: An Anthropology of Economic Regulation in Central Africa. In In-formation series.

Sheild Johansson, M. (2020) ‘Taxes for Independence Rejecting a Fiscal Model of Reciprocity in Peri-urban Bolivia’, Social Analysis, 64(2), pp. 18–37.

Digital Tax Administrations in the 21st Century: Opportunities and Challenges

By Miguel A. Fonseca and Shaun B. Grimshaw

We live our lives ever more online: we shop, we socialize, and get our news through the internet. Slowly, our interactions with government and public services have also moved into the digital sphere. In addition to lowering the costs of accessing some public services, digital systems allow for tax authorities to make it easier for taxpayers to pay their taxes correctly and on time. But these advances are not without potential pitfalls. In this post, we review some of the behavioral research done by TARC on digitalizing tax administration.

Pre-populating tax forms

Digital systems allow for tax administrations to combine (within legal privacy constraints) data from different sources to simplify filing processes. In practice, this means using third-party data such as employers, banks or pension companies to prepopulate tax forms. This is already a reality in the field: the state of California trialled prepopulates elements of its state tax returns with the Ready Return program; in addition, tax return pre-population happens to varying degrees in more than ten European Union countries and Australia.

The primary benefit of pre-populating is the reduction of errors in filing. Errors in filing decisions account for a significant portion of noncompliance: the U.K. National Audit Office estimates that it loses £6.5 billion (19%) of its tax revenues due to filing errors. Andreoni and co-authors estimate that 7% of U.S. taxpayers make mistakes when filing their tax returns. The financial case for helping taxpayers is overwhelming.

However, there are important ethical and operational concerns with pre-population of tax forms. The primary source of concerns lies in the possibility of error in the pre-population process.

One possibility is that the tax authority under-estimates taxpayers’ tax liabilities. Taxpayers, upon viewing a pre-populated form, may accept the incorrectly pre-populated values because of status quo bias, inattention, or simply because they trust the tax authority’s assessment to be correct. Such an event could lead taxpayers open to penalties in the event an audit takes place, as they would still bear legal responsibility for filing their taxes correctly.

Another possibility is that the tax authority over-estimates tax liabilities. In that case, leaving taxpayers financially worse off. In either case, there are ethical concerns given the duty of care that public administrations must have towards citizens and companies. Such errors would likely result in increase in audits, as well as a public relations blow and a potential drop in trust in government.

Behavioural inertia from pre-population is a real concern. Research on Finnish tax filing data following the implementation of pre-populated tax forms shows that taxpayers who received a prepopulated return were more likely to report the items that were prepopulated and less likely to report deductions that were not prepopulated.

TARC behavioural research on the effects of pre-population confirms that pre-population is a powerful behavioural tool; but it should only be used if the underlying data is highly reliable. Setting default levels that underestimate taxpayers’ true tax liability lead to significant drops in compliance and tax revenue.

Smart nudges

Digital systems allow for us to move beyond the old static interface that taxpayers have used for decades to relay their tax affairs to the government, best exemplified by the old paper form. Software interfaces allow for the form itself to respond in real time, and capture errors before they are submitted. Behavioral science has long argued for the use of smart, reactive nudges, which respond in real time to inputs of users. Personalising the nudge makes it more salient, and therefore more effective than static nudges that may fade into the cognitive background.

TARC research shows that nudges that respond to user inputs in electronic tax forms are significantly more effective at raising compliance than static nudges with the same content.

Feedback report pre-filing

A data-driven approach is important, not only to determine where taxpayers make errors, but also to determine how to design the informational content of the nudge itself. The increasing digitization of public services has made available vast datasets that open the door to bespoke behavioral interventions. This is possible through the use of more granular data, coming from individual entries on forms, which could enable public administrations to detect and predict common errors and design information nudges to mitigate such errors.

One such intervention

The effectiveness of information nudges has been demonstrated in a survey RCT in Finland. Following a tax rule change, researchers included information about that tax rule change in a survey to a random sample of small business owners, but not to a different random sample. By matching survey responses to tax returns data, the authors found a significant reduction in filing errors among informed business owners relative to the uninformed group. This suggests that embedding targeted information nudges within the filing process could be beneficial to taxpayers.

TARC research looked at the effectiveness of information nudges, whereby automated reminders about filing or payment obligations were sent to taxpayers in response to filing behavior in specific fields in the tax form. The nudges pointed taxpayers to publicly available information following the submission of a tax return. Relative to a baseline no-nudge, condition, nudges led to substantial re-checking of tax forms. However, nudges shown inappropriately to individuals lead to an increase in filing errors, while correctly shown nudges lead to substantial reductions in errors only if they are prescriptive in nature; generic nudges lead individuals to replace one filing error with another.

Conclusion

Digitalization has opened vast new opportunities for tax administrations to engage more directly and effectively with taxpayers. The potential to reduce non-compliance (due to error or otherwise) is there to be taken. However, there are challenges with such technologies which means tax administrations should be careful before adopting new measures. Pre-population of tax forms is already a reality in many countries, although the evidence suggests it should be restricted to extremely high-quality third-party data, as the downside risk is high. Dynamic nudges that react to user input offer great promise as low-cost interventions that may reduce the amount of non-compliance.

How are we paying for this economic crisis? EU’s new budget

Clara Volintiru and John D’Attoma

The EU is stepping up to the economic challenges posed by Covid19 with a recovery plan titled Next Generation EU of 750 billion euros. Together with the new multiannual EU budget it all rounds up at almost 2 trillion euro, which are to be dispersed through grants and loans to member states. As member states rally in solidarity, mutualizing debt, a looming issue persists: will the next generation foot the bill? Will it be worth the burden?

There is very little room for the austerity-based approach of the previous crisis which has left governments across Europe with little political capital. The continent shifts from the concept of European sovereignty to that of European solidarity, but leaders stumble on how to proceed with the European project. As always, it is a question of money: will countries pool together their resources and further the political union, or will they continue to stand apart, cautious of their national electorates’ reaction to what is characterized by many to be a “Hamiltonian moment” for Europe? Interestingly enough, recent polls show Europeans more inclined to support further integration, as the pandemic has convinced many of the need for more EU cooperation. And this is all about common action in the end – the ever-elusive convergence and cohesion across all member states, North and South, East and West. The move towards common action in the health sector in the context of the Covid19 could be the very thing to jumpstart the next phase of a more political EU.

Given the current context, with the motto of standing “together for Europe’s recovery”, Germany seems forced to take the lead and pay the bill, as the single largest economic power in the EU. But it is highly unlikely it will do so without a clear contingency plan on public finances at the national level.

Global public debt is expected to reach an all-time high, exceeding 101% of GDP, and the average overall fiscal deficit is expected to soar to 14 percent of GDP in 2020, according to the latest IMF projections. For many EU countries, the year could close with double-digit public deficits—for Spain and Italy for sure, but also likely for France, Poland and Romania.

Therefore, a new strategy to reign in public deficits is needed. Rather than slashing spending, another approach could be to strengthen tax administrations and fiscal collection through digitalization and tax administration reform. At the EU level, estimates placed the tax gap at approximately 825 billion euros per year, and in many EU member states tax gaps exceed healthcare spending. In contrast to Northern states, Southern and Eastern European countries have extensive tax gaps that could be addressed through digitalization and public administration reform. In many of the newer member states, tax revenues are only about a third of their GDP.

Even before the Covid19 pandemics, the tide was turning towards a new digital era for fiscal authorities. Governments play a pivotal role when it comes to digitizing payments in an economy—from tax collection to shifting government wages and social transfers into accounts, governments can lead by example and play a catalytic role in building a digital payments infrastructure and ecosystem where all kinds of payments—including private-sector wages, payments for the sale of agricultural goods, utility bills, school fees, remittances, and everyday purchases—are done digitally. This process yields better traceability of payments, thus countering fiscal evasion, and it has shown its merits in many European countries. However, such solutions are difficult to implement in contexts of ample subnational disparities of development as in the case of larger Central and Eastern European countries like Romania and Poland or Southern countries with consolidated informal traditions like Italy or Greece.

Institutional capacity is clearly another driving factor of fiscal collection. In our large scale behavioral experimental study of Europe and America, we found that cross-national differences in fiscal compliance could be associated with institutional differences. It is time EU realizes that general conditionalities do little in the way of convergence, and realistic technical assistance packages should be geared towards meaningful institutional reform and harmonization of practices across the EU. This is particularly important for countries with a poor track record on state capacity in Eastern or Southern Europe. It is also useful for insulating these funds from political opportunism and clientelism in countries with authoritarian tendencies such as Poland and Hungary.

We understand that improving administrative capacity is not a panacea for the tax gap and that any reform plan must realistically account for a number of other factors, such as the number of SMEs in an economy, informal norms, political opportunism, and poor institutional capacity. And the stakes are literally much higher in the context of the unprecedented financial package put forth by the EU.

Clara Volintiru is an Associate Professor at the Bucharest University of Economic Studies (ASE) and a GMF Rethink.CEE fellow 2020.

John D’Attoma is a Lecturer at the University of Exeter Business School and a member of TARC.

The Chancellor’s summer economic statement

By İrem Güçeri, Centre for Business Taxation, Saïd Business School, University of Oxford

On Wednesday, the Chancellor announced a £159 billion package to tackle the challenges arising from the Covid-19 crisis. In this blog, I will discuss three of the Chancellor’s announcements: the Coronavirus Job Retention Scheme (CJRS) phase-out plan, the series of policies under ‘Supporting Jobs’,[1] and the VAT reduction for the hospitality sector.

The Office for National Statistics (ONS) has conducted a survey on the impact of Covid-19 on UK businesses which sheds some light on their state as we move from a phase of acute disruption due to the crisis to one of initial recovery,[2] and shows which policies have been used most. The latest results, for the first half of June 2020, show that 95% of respondents (in both ‘SME’ and ‘large’ categories) used the furlough scheme, and more than half the respondents benefited from VAT payment deferrals. The response in relation to the furlough scheme is in line with evidence from Norway: Alstadsaeter et al. (2020) find that the most important schemes during the initial phases of the Covid-19 crisis have been those that relate to employer-employee relationships and in general, support the labour force.

A paper I co-authored with colleagues at the CBT, as well as Michael Devereux’s earlier blog, argue that the transition out of the furlough scheme should come partially in the form of employment subsidies, and in combination with a partial furlough applying to workers on reduced hours. Return to work on reduced hours is now supported within the furlough scheme, a welcome adjustment in line with the idea of a gradual phase-out rather than an abrupt termination of the scheme. The £1,000 Job Retention Bonus for retaining workers from October through to January is broadly in line with the employment subsidy that we proposed. However, it is not clear that the size of the subsidy is high enough to induce businesses to re-employ furloughed workers. And the fact that it is a lump-sum also means that it will be more effective in helping the re-employment of lower paid workers.

For a worker employed full-time at the minimum wage, the three-monthly salary amounts to around £4,200, in which case the employment subsidy is below 25% – which may be too low to have a significant impact. But the rate of support falls further as pay increases, making it less likely that businesses will retain higher-skilled employees and employees in more skill-intensive jobs. Overall, the employment subsidy is a welcome development, but at the current rates of support, some businesses will inevitably lay off workers with job-specific skills from October onwards. Facilitating matches between the newly-unemployed skilled workforce and vacancies may entail substantial costs. After the layoffs, re-training will be very important for these workers to return to employment.

As these workers are laid off, the demand for such workers may not pick up quickly, given the uncertainty that still prevails in the economic environment. The package allocates £2.1 billion to the Kickstart scheme, targeted at 16-24-year olds from disadvantaged backgrounds, and another £1.6 billion to apprenticeships, other youth programmes and to expanding the Jobcentre Plus support for the unemployed. Currently, what the package means for the newly-unemployed from October onwards is not spelt-out in great detail, especially for older, more experienced, and possibly higher-skilled employees.

Another major announcement is the temporary VAT rate cut for the hospitality sector from 20% to 5%. In his blog last week, Eddy Tam argued that VAT rate cuts may lead to higher demand by UK consumers, pointing to evidence from an earlier VAT rate cut during the 2008-09 recession. But this crisis is like no other. The Chancellor’s announcements on the VAT reduction and Eat Out to Help Out are very specific and may have arrived too soon.

They may have arrived too soon because the hospitality sector is still facing significant capacity constraints due to the requirement to be socially-distanced environments. That is a supply-side constraint, not a demand-side constraint. Increasing demand may then have little impact on the total size of business of the sector. Targeting the Eat Out to Help Out scheme to weekdays that are normally quiet seems like a small attempt to address this issue.

However the effects of the VAT rate cuts may also help businesses more directly. Studying a VAT rate cut for restaurants in France, Benzarti and Carloni (2019) find that 55% of the proceeds from the rate cut is absorbed by business owners, rather than the customers or the employees. In the current environment, that represents additional support for troubled businesses – even if the stated aim of the policy is to stimulate demand and employment. Second, experience shows that prices are more likely to respond to VAT increases, but they are found to be less respondent to VAT reductions in the same way (Benzarti et al., 2020). If this is the case, a temporary VAT cut might even result in higher prices after the policy ends.

The policies announced by the Chancellor on Wednesday are a welcome step in the direction of supporting a speedy recovery, to maintain otherwise viable UK businesses, and to protect and create jobs. But the Job Retention Bonus may not be of sufficient scale. And targeting very specific activities too soon may generate distortions and tighten government finances without improving the society’s overall welfare, especially if the current constraints are on the supply side rather than on the demand side.

[1] See https://www.gov.uk/government/publications/a-plan-for-jobs-documents/a-plan-for-jobs-2020.

[2] The caveat of this survey is its modest response rate, which remained at around 30% for its first 7 waves so far. Importantly, the responses come from ‘surviving’ businesses, and not from those who had to permanently stop trading.

References:

Alstadsaeter, A., Bjorkheim, J.B., Kopczuk, W., Okland, A. (2020) “Norwegian and US policies alleviate business vulnerability due to the Covid-19 shock equally well”, mimeo.

Benzarti, Y. and Carloni, D. (2019) “Who Really Benefits from Consumption Tax Cuts?

Evidence from a Large VAT Reform in France” American Economic Journal: Economic Policy, February 2019.

Benzarti, Y., Carloni, D., Harju, J, and Kosonen, T. (2020) “What Goes Up May Not Come Down: Asymmetric Incidence of Value-Added Taxes”, Journal of Political Economy, December 2020.

This blog was originally published by the Centre for Business Taxation (CBT) (http://business-taxation.sbsblogs.co.uk/2020/07/13/the-chancellors-summer-economic-statement/

Recent relevant research from the Centre for Business Taxation:

Discretionary Fiscal Responses to the Covid-19 Pandemic, Michael P. Devereux, İrem Güçeri, Martin Simmler and Eddy Tam, Oxford Review of Economic Policy, June 2020.

Tax Policy and the COVID-19 Crisis, Richard Collier, Alice Pirlot, John Vella, Intertax, forthcoming.

COVID-19 Challenges for the Arm’s-Length Principle, Matt Andrew and Richard Collier, Tax Notes, Volume 98, Number 12, June 22, 2020.

Chronicle of a Crisis Foretold? Latin America in the time of Coronavirus: Revenues, Growth and Policy Responses.

By Matteo Pazzona, Brunel University London

According to the World Health Organization, Latin America is the current epicentre of the Covid-19 pandemic. While many countries have been able to control the spread of the virus, in Latin America the peak has yet to be reached. Some numbers might help signify the extent of the looming crisis. Brazil is the second country in the world in terms of deaths and confirmed cases. Peru, an early adopter of lockdown measures together with Chile, sits 8th in the inauspicious global ranking of contagions, with more than 240,000 confirmed cases. In Chile, the situation seems to be out of control and it is the 5th country in the world in terms of cases per capita, although testing six times more than Brazil. Mexico adopted a late response and has now more than 22,000 deaths, a number which (as with all these numbers) is probably underestimated. The virus could spread in the region thanks to the high number of informal sector workers, the high level of urbanization and weak health systems, which make the lockdowns measures difficult to enforce. There are success stories too: countries like Uruguay, Paraguay, Argentina, and Nicaragua show low levels of cases and deaths, for now at least. Argentina has around a tenth of confirmed cases and deaths compared to Peru, a country of similar population. In Colombia, the city of Medellin acted fast and with the help of technology was able to limit the spread of the virus.

The challenges ahead for governments, and particularly tax authoritiesin these countries, are considerable. The crisis will negatively impact tax revenues directly – through lower taxable income and consumption- but also a decrease in tax compliance, especially from the struggling segments of the population. Fiscal authorities will need to need to adapt their tax strategies to accomplish fiscal sustainability and promote economic recovery. According to a recent report, in 2020 the region GDP will decrease by 7.4 %, the largest slump in the world. The two biggest economies, Brazil and Mexico, will have a negative growth of 7.6 % and 8.5 % respectively. The current crisis is happening after a period of low growth which started in 2014, caused mainly by the drop in commodity and oil prices. The current crisis leads to further drops: countries such as Brazil, Chile, Venezuela, or Peru are already experiencing a drastic reduction in exports which is likely to extend for many more quarters. The tourism industry, which represents a significant share of employment and revenues, has also been severely hit.

Besides, the economic structure of many Latin American countries is dominated by small companies (99% according to the OECD) which being less likely to have a financial buffer to survive the crisis, might go bankrupt rapidly. There has been also a significant decrease in remittances flow from migrants working abroad. According to the World Bank, the region will experience a 20% decline in the flow, the highest ever recorded. Financial volatility has also been a constant in the last months, with many currencies devaluating and significant capital flight. The pandemic will also lead to a surge in inequality and poverty, as reported by the World Bank. That is very unfortunate, especially because many countries had managed to decrease their levels in the last two decades. The current crisis will also be costly in terms of human capital accumulation, which will affect the most fragile sectors of the population. All this inevitably will have a significant impact on tax revenues, and the growth trajectory of the economies.

Latin American governments have implemented a wide range of welfare programs to sustain individuals and firms. They have helped vulnerable households through direct transfers or employment subsidies, among others. For example, Brazil extended the well-known and successful Bolsa Familia program and created a new transfer scheme for informal workers. Several countries, for example El Salvador, have helped directly or indirectly the firms through tax breaks, loan instalments, and public credit guarantees. However, the fiscal power of many countries is limited compared to richer ones and the fiscal space is further restricted by six consecutive years of soaring debt/GDP ratio, due mainly to the effects of low commodity prices on government revenues. The large share of the informal economy, 40% according to the OECD, further constrain the fiscal power of the region. Despite this, the countries that managed to create a fiscal buffer in the last years and have better access to the financial markets were able to implement more aggressive policies. For example, the fiscal COVID-19 related spending in Peru accounts for 12 % of the GDP, 10 % in Brazil, and 7 % in Chile according to IMF data. On the other hand, Mexico will spend between 0.6 % and 1% of the GDP in such measures (depending on the source used). These figures need to be taken cautiously because it is difficult to identify COVID-related expenditures from normal ones. Moreover, tax breaks or credit guarantees are not visible in fiscal accounts.

Fortunately, countries in Latin America will receive international financial help. The Inter-American Development Bank increased the loans to countries by $3,300 million, plus $5,000 to sustain the private sector. The World Bank Group committed to providing $160 billion to alleviate the health, economic, and social impacts of COVID-19 around the world and a big part of these funds will go to the region. The IMF has also secured a significant amount of money to help many countries in the region.

Recent Comments