By Wenya Cheng (University of Glasgow) and John Morrow (Birkbeck, University of London)

Although firms may face radically different production conditions, this dimension of firm heterogeneity is often overlooked. A number of studies document large and persistent differences in productivity across both countries and firms.[1] However, these differences remain largely ‘some sort of measure of our ignorance’. It’s therefore worth inquiring to what extent the supply characteristics of regional input markets help explain such systematic productivity dispersion across firms, differences which remain a ‘black box’.[2] It would be surprising if disparate factor markets result in similar outcomes, when clearly the prices and quality of inputs available vary considerably, as when markets are thin, incomplete, distorted or highly heterogeneous: in short, in most developing country markets. Recent work has indicated imperfect factor mobility has sizable economic effects and that developing country distortions are large.[3] Our recent work models firm adaptation to such variation in a general equilibrium framework which microfounds these distortions and heterogeneity.[4] The structural equations of the model are simple to estimate and the estimation results quantify the importance of local factor markets for firm input use, productivity and welfare.

To better understand the environments that firms operate in, we model regional inputs markets with differing distributions of worker types, wages and regional input quality. Firms can hire different types of labor (e.g. education groups or occupations) and within each type, worker quality varies and incurs search costs. As the ease of finding higher quality workers increases with their regional supply, firm hiring depends on the joint distribution of worker types and wages. Our estimates indeed confirm that contrary to standard models with perfectly competitive labor markets, firm hiring responds to not only wages, but also the availability of worker types. Since each firm’s optimal workforce varies by industry and region, the comparative advantage of regions varies with its labor market characteristics. Since industries also differ in factor intensity, local capital and materials costs also influence the comparative advantage of a region. As the model also explicitly models entry, firms locate in proportion to the cost advantages available.

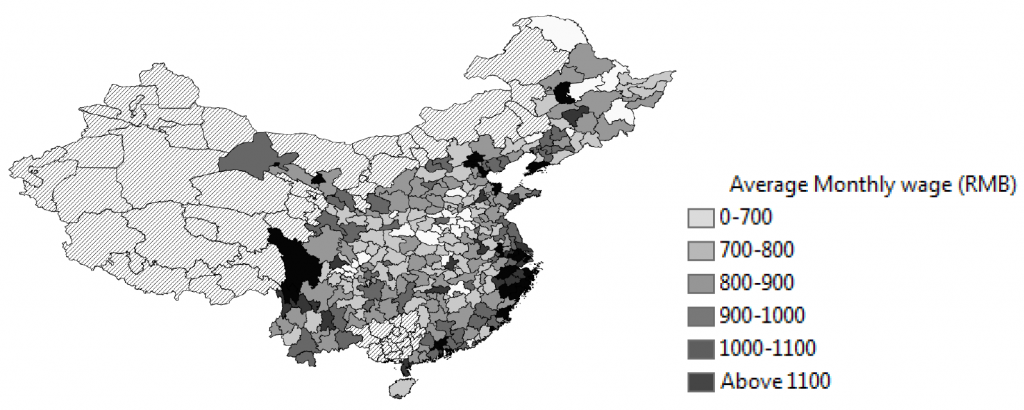

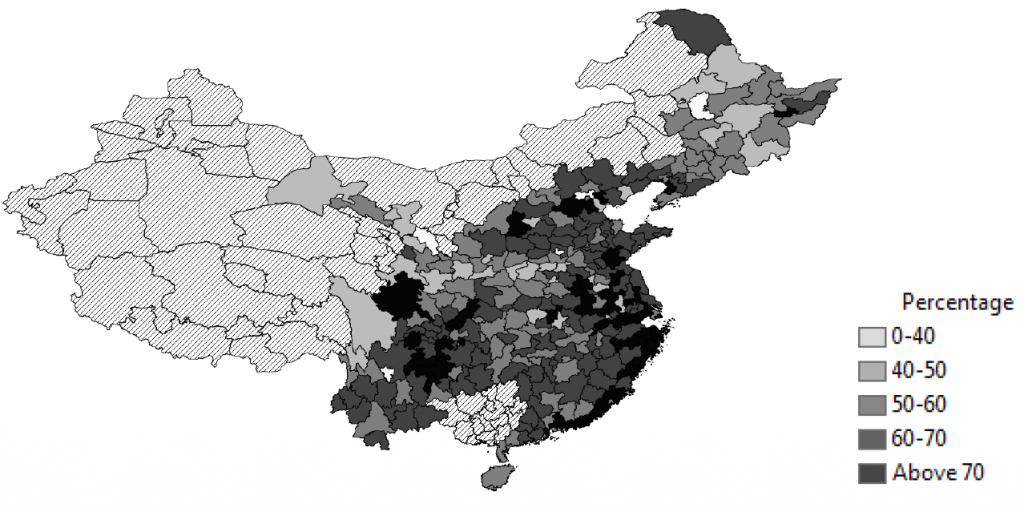

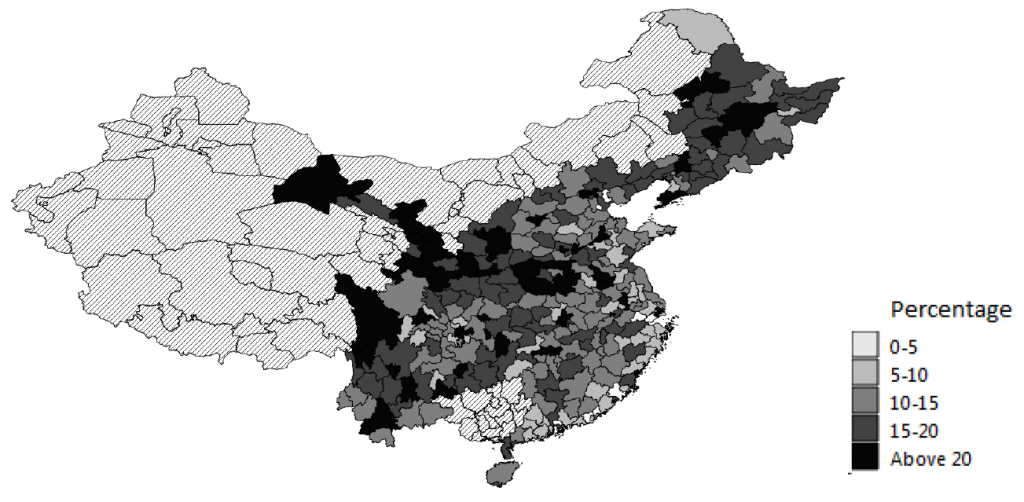

To quantify real world supply conditions, we use the model to derive estimating equations which fix: 1) hiring by wage and worker type distributions, 2) substitution into non-labor inputs and 3) firm location in response to local factor markets. The estimation strategy combines manufacturing and population census data for China in the mid-2000s, a setting which exhibits substantial local variation (see Figures 1, 2 a,b).

Figure 1 Chinese Prefectures Average Monthly Income of Employees (2005)

Figure 2 (a) % of Labor Force with less than or equal to Junior High School

Figure 2 (b) % of Labor Force with greater than or equal to Junior College

By revealing how firm demand for skills varies with local conditions, the model quantifies the unit costs for labor across China. The estimates based on within-firm hiring patterns imply interquartile differences in effective labor costs across prefectures which range from 30 to 80 percent (see Figure 3). Taking into account industry level production estimates of capital, labor and materials expenditure shares, these labor cost differences imply productivity differences of 3 to 12 percent. This helps explain the productivity difference ‘black box’ by reducing the variance of productivity residuals in every industry compared to a production function using counts of worker types or the wage bill. Extending this approach we also find that capital and materials frictions combined explain a similar range of productivity differences.

Figure 3: Geographic Dispersion of Unit Labor Costs: General Machines

The model has welfare implications for microeconomic changes in labor markets that shift regional comparative advantage and thereby the distribution of industry activity in general equilibrium. For instance, if the highly heterogenous distribution of workers and wages is due to regional frictions (e.g. the hukou system in China) then homogenizing worker distributions and wages across labor markets helps capture what the removal of these frictions might imply. In theory, this homogenization could lead to gains from variety being more evenly sourced across regions but could also lessen regional comparative advantages and gains from specialization. Ultimately these competing forces must be resolved quantitatively. Using Input-Output and population data, the model implies that homogenizing across factor markets would, on net, increase real incomes by 1.33 percent.

The importance of local factor markets for understanding firm behavior suggests new dimensions for policy analysis. For instance, regions with labor markets which generate lower unit labor costs for an industry attract higher levels industry activity. As unit labor costs depend on the distribution of wages and worker types that represent substitution options, this yields a deeper view of how educational policy or flows of different worker types impact firms. For this reason, work evaluating wage determination could be enriched by taking this approach. Taken as a whole, the results show that policy changes which influence the composition of regional labor markets will likely have sizeable effects on firm productivity and location. Finally, the substantial differences within industry suggest that at the regional level, inherent comparative advantages exist which policymakers might leverage.

In fact, relatively little is known about the dynamic relationships between labor markets and firm behavior, and this paper provides both a general equilibrium theory and structural estimation strategy to evaluate these linkages.[5] Having seen that cost and productivity differences inherent in local factor markets are potentially large, our approach could be of use in evaluating trade offs between regional policies or ongoing trends across regions. Further work could leverage or extend the approach of combining firm, census and geographic data to better understand the role of local factor markets on firm behavior.

References

Cheng, W. and J. Morrow, (2018); “Firm Productivity Differences from Factor Markets.” Journal of Industrial Economics, 66(1): 126–171.

Hsieh, C. T. and P. J. Klenow, (2009); “Misallocation and Manufacturing TFP in China and India.” Quarterly Journal of Economics, 124(4): 1403–1448.

Melitz, M.J. and S.J. Redding, (2014); “Heterogeneous Firms and Trade.” Handbook of International Economics, Vol. 4: 1–54.

Ottaviano, G., and G. Peri, (2013) “New Frontiers of Immigration Research: Cities and Firms.” Journal of Regional Science, 53(1): 1–7.

Syverson, C., (2011); “What Determines Productivity?” Journal of Economic Literature, 49(2): 326–365.

Topalova, P., (2010); “Factor Immobility and Regional Impacts of Trade Liberalization: Evidence on Poverty from India.” American Economic Journal: Applied Economics, 2(4): 1–41.

Endnotes

[1] See Syverson (2011).

[2] See Melitz and Redding (2014).

[3] See Topalova (2010) and Hsieh and Klenow (2009).

[4] See Cheng and Morrow (2018).

[5] See Ottaviano and Peri (2013).