By Rafael Dix-Carneiro (Duke University), Rodrigo R. Soares (Columbia University), and Gabriel Ulyssea (University of Oxford)

The idea that economic crises can lead to increased crime is far from new, dating back at least to the Great Depression of the 1930s.[1] Such concern is well justified, as crime imposes a substantial welfare cost on society. However, estimating the causal effect of economic conditions on crime and quantifying this relationship has proven to be elusive. Indeed, finding an exogenous variation in economic conditions is quite challenging and there are different potential threats to identification, such as omitted variable bias and reverse causality.[2]

In a recent paper, we overcome these challenges by exploiting the Brazilian trade liberalization of the 1990s, which provides a natural experiment that generated exogenous shocks to local economies in the country.[3] Brazil is a particularly appealing empirical setting, as there is little evidence on the effect of economic conditions on crime in developing countries with a high incidence of crime. In 2013, Brazil was ranked first worldwide in absolute number of homicides (more than 50,000 occurrences per year) and 14th in homicide rates, with 25.2 homicides per 100,000 inhabitants.[4] However, the country is not an outlier within Latin America and the Caribbean: according to the UNODC, 14 of the 20 most violent countries in the world are located in the region. Besides high incidence of crime, these countries also have in common poor labor market conditions, weak educational systems, and high levels of inequality. In such context, adverse economic shocks can have more severe effects on crime, with potentially larger welfare implications.

In our empirical design, we follow the previous literature[5] and exploit two features of the Brazilian context. First, the trade liberalization episode was not only characterized by large tariff reductions – which fell from 30.5% to 12.8% between 1990 and 1994 – but there was also substantial variation in the intensity of tariff cuts across industries. Second, regions in Brazil have very different economic structures and specialize in the production of different baskets of goods. The combination of these two features therefore implies that the trade liberalization leads to very different levels of exposure to foreign competition across regions. For example, Traipu in the state of Alagoas was largely specialized in agriculture, which actually experienced a slight increase in the level of protection (i.e. tariffs). In contrast, Rio de Janeiro specialized in apparel and food processing, both of which experienced substantial tariff reductions. Thus, one could expect Rio de Janeiro to be more adversely affected by the trade opening than Traipu. This reasoning provides the base for our empirical approach, which exploits this exogenous variation in exposure to the trade shock across regions.

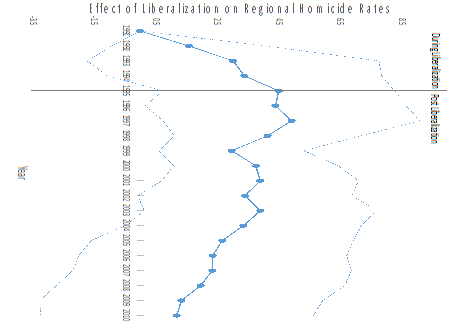

We show that regions more exposed to the trade shock – i.e. more specialized in industries facing larger tariff reductions – experienced a relative increase in the number of homicides in the years immediately after the end of the trade liberalization, but the effect completely vanishes in the long run. This can be seen in Figure 1, which shows the differential increase in the logarithm of crime rates in regions facing larger reductions in tariffs relative to regions that experienced lower tariff reductions. This large effect contrasts with those found in the previous literature, which typically shows that worse economic conditions are associated to higher property crime, but find no effects on homicides. However, previous studies have focused on developed countries (Mustard 2010), which have relatively low crime rates and stronger baseline economic conditions (i.e. lower inequality and better functioning labor markets).

Figure 1 Effect of Trade liberalization on Regional Homicide Rates

Having established the overall effect of the trade shock on crime, we use the dynamics of this effect to directly investigate its potential channels. We show that the trade shock substantially affected different potential determinants of crime, such as labor market conditions, public goods provision (public safety and government spending), and income inequality. However, only the effect on labor market conditions (as measured by employment rates) follows the same dynamic pattern as the effect of the trade shocks on crime. Importantly, these two dynamic responses are very different from those observed for other potential determinants, such as public goods provision and inequality. This strongly indicates that the employment rate is the key channel to explain how these local trade shocks affected crime. In the paper, we develop an econometric framework that exploits these different dynamic responses to identify lower and upper bounds for the effect of labor market conditions on crime. We find that employment rates accounted for 75–93% of the observed effect of the trade shocks on crime.

In sum, our results highlight that crime is an important dimension of the adjustment costs to trade shocks. Hence, to the extent that trade opening leads to transitional unemployment, there can be substantial externalities associated to this adjustment process in the form of temporarily higher crime rates. Moreover, our results indicate that employment rates are the key mediating channel of the overall effect of trade opening on crime.

Interestingly, earlier research shows that the long-run employment recovery in Brazil occurred exclusively via informal employment, as formal employment does not recover even 20 years after the trade opening episode.[vi] These results therefore suggest that informal jobs were crucial in keeping individuals away from criminal activities, despite the fact that they might be of lower quality when compared to those in the formal sector. If this is indeed the case, stricter enforcement of labor regulations could exacerbate the response of crime to adverse economic shocks. Put differently, our results suggest that more lax enforcement of labor regulations – and active labor market policies – may help to prevent increases in crime during economic downturns.

References

Dix-Carneiro, R., R. Soares and G. Ulyssea (2018); “Economic Shocks and Crime: Evidence from the Brazilian Trade Liberalization.” American Economic Journal: Applied Economics, 10(4), 158-95.

Dix-Carneiro, R., and B. Kovak (2017a); “Trade Liberalization and Regional Dynamics.” American Economic Review, 107(10), 2908-46.

Dix-Carneiro, R., and B. Kovak (2017b); “Margins of Labor Market Adjustment to Trade.” Journal of International Economics, 117, 125-142.

Fishback, P.V., R.S. Johnson, and S. Kantor (2010); “Striking at the Roots of Crime: The Impact of Welfare Spending on Crime During the Great Depression.” Journal of Law and Economics, 53(4): 715-740

King, L (2009); “Statistics Point to Increase in Crime During Recessions [5]”, The Virginia Pilot, 19 January.

Mustard, D B (2010); “How do Labor Markets Affect Crime? New Evidence on an Old Puzzle.” Published in B Benson and P Zimmerman (eds), Handbook on the Economics of Crime, Edward Elgar, Chapter 14: 342–358.

UNODC (2013); “Global Study on Homicide [7]”, United Nations Office on Drugs and Crime.

Endnotes

[1] See e.g. Fishback, Johnson and Kantor (2010).

[2] Mustard (2010).

[3] Dix-Carneiro, Soares and Ulysssea (2018).

[4] UNODC (2013).

[5] See Dix-Carneiro and Kovak (2017a, b).

[6] Dix-Carneiro and Kovak (2017b).