By Simone Moriconi (IESEG School of Management and LEM), Giovanni Peri (University of California Davis), and Riccardo Turati (Université Catholique de Louvain)

The idea that political support for redistribution and public good provision is lower in societies with high exposure to immigration and diversity is widely acknowledged. In the US, the great migration inflows of the early 20th century, despite having positive economic effects, reduced public support for the provision of public goods.[1] Similarly in Europe, the inflow of low skilled immigrants during the 2000s weakened citizens’ preferences for redistribution.[2] Natives generally perceive immigrants as a burden to their country’s welfare system, especially if their income is lower, and if they choose their location based on the generosity of the local welfare state (the so-called ‘welfare magnet theory’). Recent experimental evidence confirms these findings and demonstrates that immigrants’ characteristics are important in affecting the link between immigration and natives’ attitudes towards the welfare state.[3] For instance, high-skilled immigrants, who are most often perceived as net contributors to the welfare state, do not generate anti-welfare attitudes in natives.

Given this evidence, it is important to see how the effect of immigration on preferences translates into policies. A straightforward way is to look at the effect of immigration on voting outcomes. This is the objective of our recent paper, which discusses how migration affected voters’ political preferences over welfare state and public education expansion over 28 elections in 12 European countries between 2007 and 2016.[4] For this analysis, we have primarily used data from the European Social Survey (ESS). These extremely detailed individual data include the name of the party voted for by survey respondents at the last national election. Thus, we selected countries characterized by at least 2 elections during the sample period and linked to each party a synthetic measure, drawn from the party’s political manifesto, of that party’s support for an expansion of the welfare state or for public education. Finally, we merged these data with the stock of immigrants, classified by their education level, who were resident in the region of the survey respondent in the year of the election.

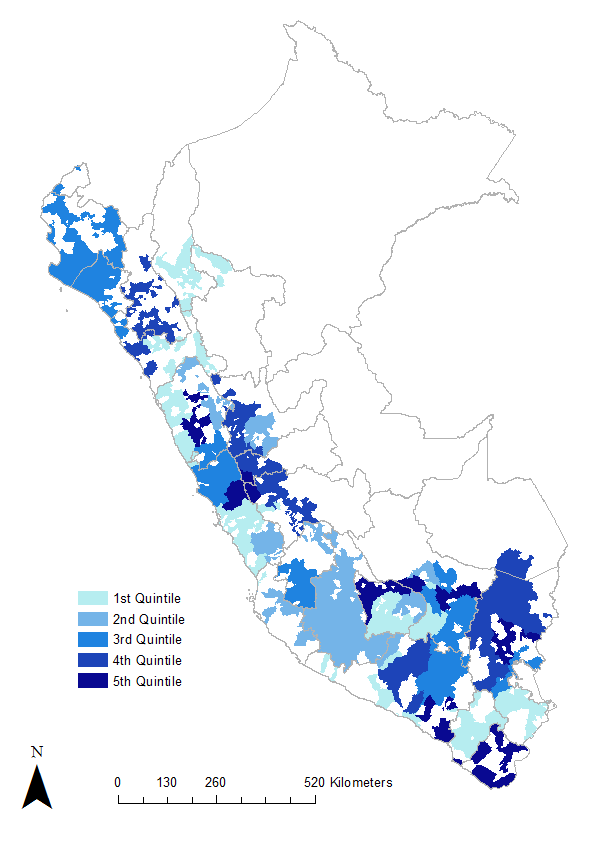

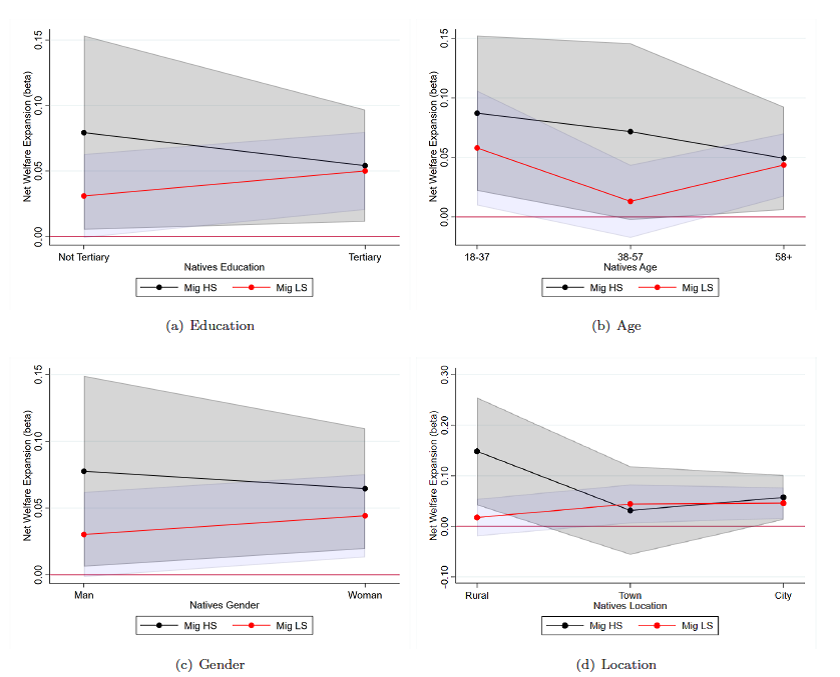

Using these data, we show that voting outcomes are significantly related to the local exposure to immigration, with different effects of low skilled and high skilled immigrants. An increase of high skilled immigration to the region makes individual voters more prone to vote in favour of parties with a political manifesto favourable to welfare and public education expansions. This remains true after accounting for confounding factors, most importantly omitted variable bias driven by the fact that migrants may choose to go to richer regions, and where natives are more pro-redistribution. Our dataset also allows us to show that the effect of high skilled migration on voting outcomes varies with voters’ characteristics. Figure 1 shows the effect is generally larger among the less educated, male voters, residing in small rural areas and it is concentrated either in the younger cohort of natives (below 38 y.o) or the older ones (above 58 y.o.). Educated, female, prime-age and urban voters don’t seem to respond with the same intensity.

Figure 1 : New Welfare State Expansion and Natives’ Individual Characteristics

Source: Moriconi, Peri, and Turati (2019). The graphs plot the coefficients for the effects of the share of high skilled and low skilled immigrants on the indicator of preference for a net welfare expansion. Coefficients are estimated on different subsamples by individual characteristics of natives: education (a), age (b), gender (c) and location (d). All the coefficients are estimated with IV estimations. The shadowed area represents the 95% interval of confidence. All the regressions include individual and regional controls, NUTS2 and year fixed effects. These are the authors’ calculations on ESS, Manifesto Project Database and Eurostat data.

What about the effects of low skilled migration? As for the welfare state dimension of redistribution, low skilled migration does not seem to have much effect on the voting behaviour of natives (see Figure 1). However, we find that natives respond to low skilled immigration by voting for parties that propose to reduce public education: natives may prefer to reduce spending on local public goods fearing that these will benefit primarily less-skilled (and low-income) immigrants.[5] And public education could be benefitting especially newly arrived migrants, who are younger and have more children.

Are the estimated effects sizeable ones? Our estimated coefficients suggest that an increase in the stock of high skilled immigrants by 3 percentage points implies a shift of voters from a moderate Centrist-agenda on education provision and redistribution to the more progressive type of political platforms that characterize most Socialist parties in Europe. An effect quantitatively similar, but with an opposite sign (i.e. a switch towards parties less-favourable to redistribution) is induced instead by an increase in the share of less-educated immigrants by 6 percentage points.

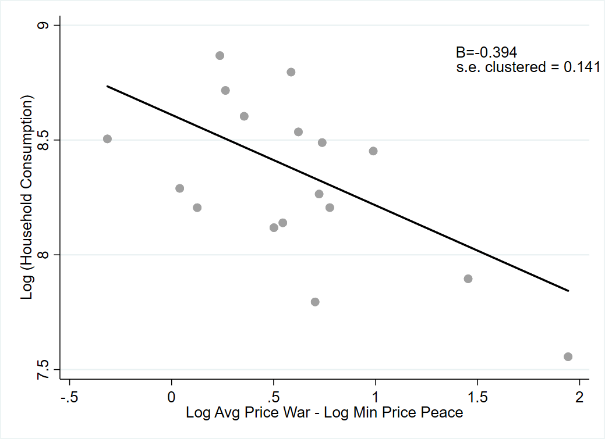

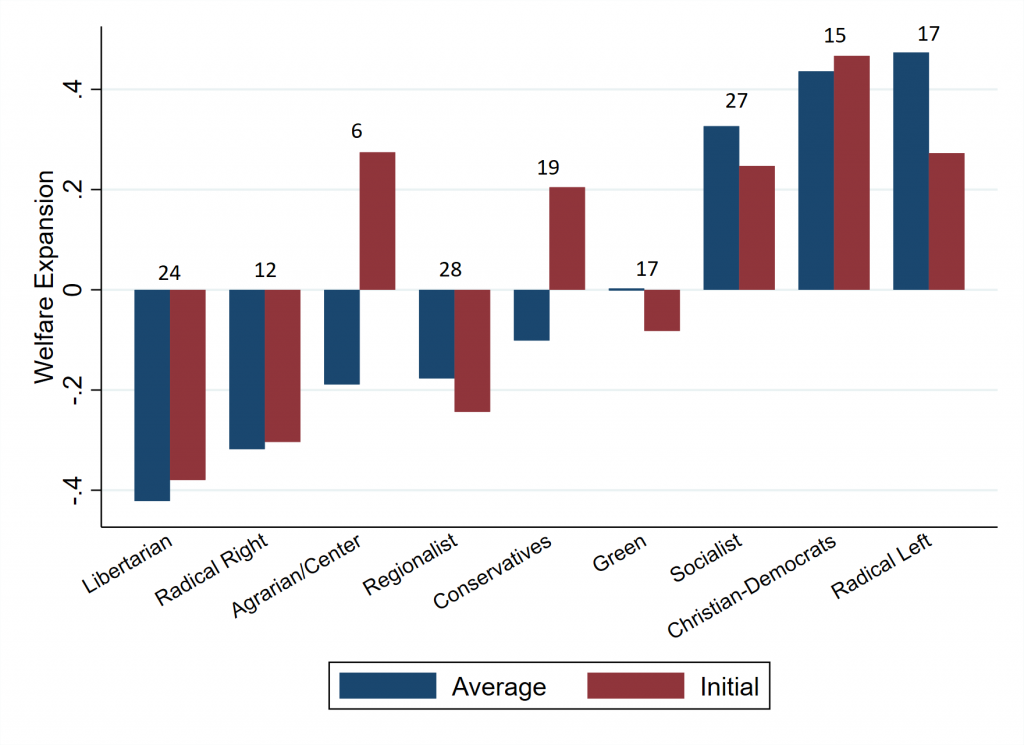

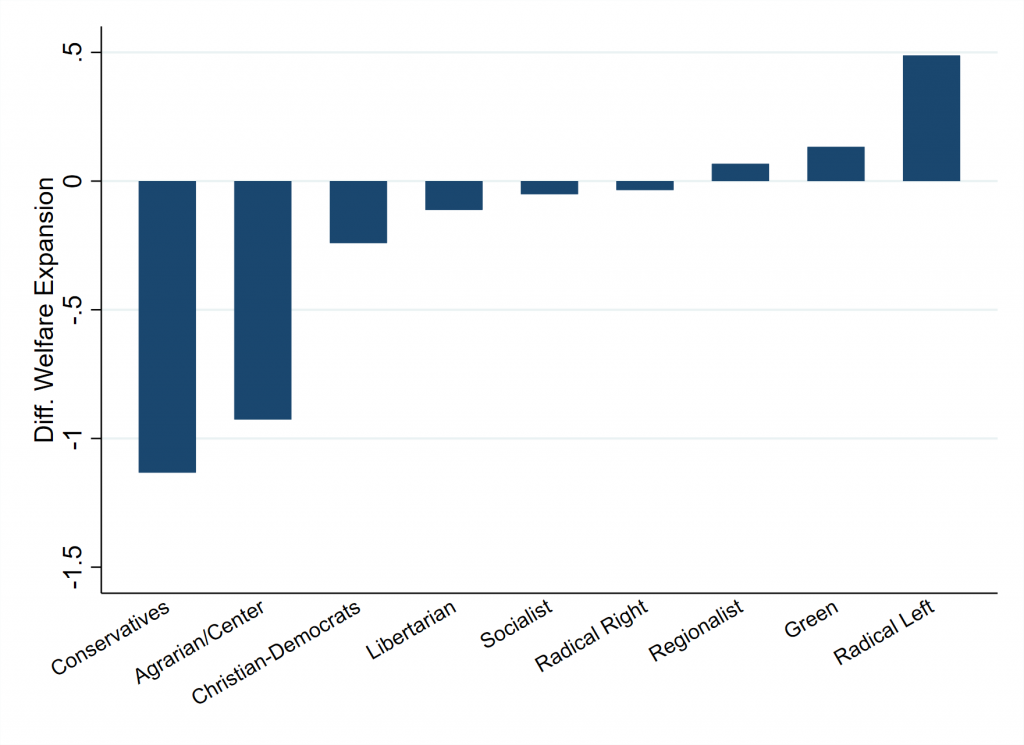

We also perform a complementary exercise to check whether country-level immigration induces parties themselves to change their political agenda. We find that an inflow of low skilled migrants induces parties in a country to propose a political manifesto less favourable to welfare state expansion. This suggests that not only voters, but also parties are to be considered “political agents”, as they adjust their attitudes towards redistribution. As shown in Figure 2 below, this is not only the case for conservative types of parties, but also for some “pro-redistribution” parties such as the Christian Democrats. Our findings suggest that in response to low skilled immigration, European countries’ party systems may have evolved over time to support smaller government size, and this would amount to a change in policy preferences revealed by parties even if voters did not much change their vote across parties.

Figure 2: Parties Families – Average position and Variation

Source: Moriconi, Peri and Turati (2018). The top panel plots the average position of political families, using the initial and the average political position of parties. Initial position is measured by the manifesto in the last available election before the start of the sample period, or the first year when the party is present in the political arena during the sample period (2007-2016). Average political position is measured as the average political manifesto of a party during the sample period 2007-2016. Number of parties in each family are reported over the bars. The bottom panel plots the variation of political families average position regarding welfare state expansion keeping a balanced sample of parties.

References

Alesina, A., A. Miano & S. Stantcheva (2018). “Immigration and Redistribution.” NBER Working paper 24733.

Card, D., C. Dustmann & I. Preston (2012). “Immigration, Wages and Compositional Amenities.” Journal of the European Economic Association 10(1): 78–119.

Moriconi S., Peri G. and R. Turati (2019). “Immigration and Voting for Redistribution: Evidence from European Elections.” Labour Economics 61 (2019) 101765.

Murard, E. (2017). “Less Welfare or Fewer Foreigners? Immigrant Inflows and Public Opinion towards Redistribution and Migration Policy.” IZA DP No. 10805.

Tabellini, M. (2020). “Gifts of the Immigrants, Woes of the Natives: Lessons from the Age of Mass Migration.” Review of Economic Studies 87(1): 454–486,

Endnotes

[1] See Tabellini (2020)

[2] See e.g. Murard (2017)

[3] Alesina et al. (2018)

[4] Moriconi et al. (2019)

[5] Card et al. (2012)